GLOBAL ECONOMICS

IMMIGRATION PAPERS

Patrick Grady

The Economic Impact on Canada of Immigration

January 11, 2006

In his book Heavenís Door: Immigration Policy and the American Economy, Professor George J. Borjas of Harvard University, who is America's leading authority on the economics of immigration, presents the simplest textbook model of how immigration works in a market economy.1 It is the same supply and demand model that is used in classrooms around the world to illustrate the economic impact of government policies such as lowering trade barriers, raising the minimum wage, levying taxes, and agricultural subsidies. While granted that the model may be oversimplified in that it assumes that all labour is homogeneous and that machinery and equipment, land, and other productive resources are fixed and that it ignores any dynamic impact of immigration, it is a good starting point for an analysis of the economic impacts of immigration in Canada. This is something that is badly needed given the emotional and non-analytic basis of most of the public discussion of the immigration issue in Canada.

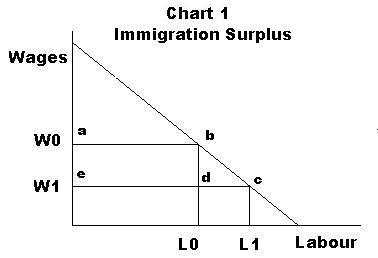

The model is portrayed in Chart 1. Wages are shown on the vertical axis and the

supply of labour on the horizontal. As in all partial equilibrium models, wages and

employment levels are set by the interaction of supply and demand. Its simple, but powerful, logic is that

the greater is the supply of labour, the lower must be the wage to encourage employers to

hire all the workers seeking employment. As an example of how this works graphically consider that,

if immigration increases the labour supply from L0 to L1, the downward sloping demand for

labour implies that wages must fall from W0 to W1. This produces a loss of earnings for

existing workers who then earn the lower wage W1 instead of W0. Their lost earnings is shown by

the rectangle abde and can be calculated as (W1-W0)*L0. The employers (or users of labour

services) gain from these lower earnings of their existing and immigrant labour forces, which

represents a redistribution in their favour from labour. The benefit to the economy is the

familiar area in the triangle bcd, which represents the welfare gain from employing the

additional immigrant workers. It should be emphasized that this welfare gain is always much

smaller than the lost earnings as long as the number of immigrants is not too large relative

to the size of the existing labour force.

In this case, the loss to existing workers is:

Decrease in the Income of Existing Workers as a fraction of GDP = labourís share of national income * percentage drop in native wage due to immigration * fraction of labour force that is not immigrants.

The gain to existing users of labour services is:

Gains to Existing Users of Labour Services as a fraction of GDP = labourís share of national income * percentage drop in native wage due to immigration * (1- .5* fraction of labour force that is not immigrants).

And last, and quantitatively least, the welfare gain to the economy or immigration surplus can be measured using the formula:

Immigration surplus = .5*(W0-W1)*(L1-L0).

Specified as a share of GDP and taking into account some simple macroeconomic relationships, it can be written:

Immigration surplus as a fraction of GDP = .5 * labourís share of national income * percentage drop in native wage due to immigration * fraction of labour force that is immigrant.

All thatís needed now to get a specific quantitative estimate for Canada is to fill in the parameters. The labour share of national income was 67 per cent in 2000 and 66 per cent in 2004. The fraction of the labour force that was immigrant according to the 2001 Census was 18.4 per cent (and is growing about 0.6 or 0.7 per cent per year, which is the fraction of the labour force representing the annual flow of immigration). The percentage decrease in wages due to a 17-percent increase in the labour supply was estimated by Hamermesh to be 5 per cent. This implies an estimate for the elasticity of native wages with respect to immigration of 0.29.2 Multiplying this elasticity times the increase in the labour supply from immigration provides the required estimate of the percentage drop in native wages due to immigration.

Based on these parameters, the immigration surplus for Canada, which represents an estimate of the cumulative economic benefits of immigration, can be calculated to have been 0.33 per cent of GDP in 2001 or $3,594 million (Table 1). The most striking thing about this estimate is that it is not very large in macroeconomic terms, especially when contrasted with the large redistribution of income that results from immigration. The decrease in the income of native workers resulting from the impact of immigration on wages was much larger at $31,915 million. Given the magnitude of this adverse redistributive impact, it's surprising that labour unions aren't more resistant to high levels of immigration. And the transfer to employers and consumers who directly or indirectly use immigrant services, which incorporates the immigration surplus as well as the wage loss, was $35,509 million. Largest of all was the earning of the immigrants themselves, which could be estimated to be $132,952 million (by applying the immigrant share of the population to wages and salaries). Not surprisingly, the immigrants are thus the ones who benefit by far the most from immigration. While obvious, this is not something that is often mentioned in Canada.

| Percent of | ||

| GDP | Million $ | |

| Loss to Existing Workers | ||

| From Stock | 2.96 | 31,915 |

| From Annual Flow | 0.14 | 1,558 |

| From 10-year Flow | 1.35 | 14,526 |

| Gains to Existing Users of Immigration Services | ||

| From Stock | 3.30 | 35,509 |

| From Annual Flow | 0.15 | 1,564 |

| From 10-year Flow | 1.40 | 15,111 |

| Immigration Surplus | ||

| From Stock | 0.33 | 3,594 |

| From Annual Flow | 0.0005 | 6 |

| From 10-year Flow | 0.05 | 585 |

It is noteworthy that the estimates of the loss to existing workers in Canada from lower wages at $31,195 million is relatively larger than the US$151 billion wage loss estimated by Borjas for the United States (2.96 per cent of GDP in Canada versus 1.89 in the U.S.). And the immigration surplus for Canada, while still smaller in absolute terms than the US$8 billion estimated by Borjas, is more than three times larger in relative terms than his estimate of 0.1 per cent. This reflects primarily the lower 10-per-cent level of the immigrant population in the United States in 1998, Borjasís reference year.

There are three problems with the immigration surplus concept that need to be considered. One problem is that it is static, holding machinery and equipment, land, and other productive resources fixed. The downward sloping demand for labour in a partial equilibrium model is produced by the diminishing returns produced by applying an increasing amount of labour to a fixed amount of capital. This is obviously not a very realistic assumption over the multi-generational time span required for immigration to build up to the 2001 levels of 18.4 per cent of the population. Some immigrants may bring capital with them and over time firms will invest to take advantage of the higher returns resulting from the increased availability of labour. If the assumption that other factors of production are fixed is relaxed and instead they are allowed to increase in step with labour as occurs in neoclassical growth models, there would be no decline in wages and hence no immigration surplus. Many boosters of higher immigration would be surprised to learn that for immigration to produce a benefit in a static partial equilibrium model, it must produce a decline in wages. No pain no gain.

A second problem is that the model assumes constant returns to scale and ignores any potential economies of scale resulting from immigration-induced increases in the labour force. However, judging from the evidence on the relative success of economies of different size, such as Hong Kong versus China, this is probably a non-problem. With international trade allowing all economies to enjoy the benefits of specialization and economies of scale, bigger is not necessarily better.

The third problem is that the immigration surplus as calculated by Borjas is a backward-looking measure of the impact of immigration and is thus not so useful for policy discussions which usually focus on the desirability of future flows of immigration and not of the impact of changes to the past stock. Consequently, it is useful to consider an alternative estimate of the immigration surplus associated with one yearís flow such as the 235,824 immigrants who entered the country in 2004, the most recent year for which data is available. As can be seen in Table 1, the immigration surplus for a given year is virtually negligible, and even if it is allowed to build up over a 10-period, it remains relatively small at $585 million or 0.05 per cent of GDP. This is not to say that the economic impact of continuing current annual flows of immigration would be entirely negligible. There would still be a wage loss to existing workers of $14,526 million or 1.35 per cent of GDP, which is definitely too large to ignore.

The small level of the immigration surplus has important implications for immigration policy. It means that, unless there are dynamic factors that are not captured by the static partial equilibrium analysis and that produce a large net benefit for Canada, any benefit to the Canadian economy from immigration must come from a net fiscal transfer to other Canadians from immigrants resulting from the functioning of our progressive system of taxation and government spending on social and health programs.

The only available recent study of the fiscal contribution of immigrants by Herbert Grubel is not very encouraging about the fiscal contributions likely to be made by immigrants. To the contrary, it suggests that, rather than making the required net fiscal contribution, recent immigrants have been making a net claim on the country's fiscal resources because of their poor labour market performance and relatively low incomes. His, admittedly crude, but also conservative, estimate is that the cohort of immigrants who entered the country in 1990 received net fiscal transfers of $6,294 each or $1.36 billion in total. And applying this to the 2.9 million immigrants that entered the country between 1990 and 2003, he estimates the total net fiscal transfers to recent immigrants would be $18.3 billion per year, which is a number much higher than any likely estimate of the immigration surplus.3

If the immigrants entering the country over

the next decade perform similarly, any small immigrant surplus that may be produced will be swamped by the large magnitude of the

fiscal transfers they will receive from other Canadian taxpayers. And this is on top of the

adverse distributional impact of the reduced earnings of existing workers resulting from the increased supply of labour. The only way to ensure

that immigration benefits all Canadians is to improve immigrant selection so that future

immigrants have the characteristics that enable them to earn more than existing Canadians and

consequently pay more in taxes than they receive in government spending benefits.

1. George J. Borjas, Heavenís Door: Immigration Policy and the American Economy (Princeton University Press, 1999), pp.89-93.

2. Daniel S. Hamermesh, Labor Demand (Princeton University Press, 1993), chapter 3.

3. Herbert Grubel, "Immigration and the Welfare State in Canada: Growing Conflicts, Constructive Solutions," Fraser Institute Public Policy Sources, Number 84, September 2005,p.19.